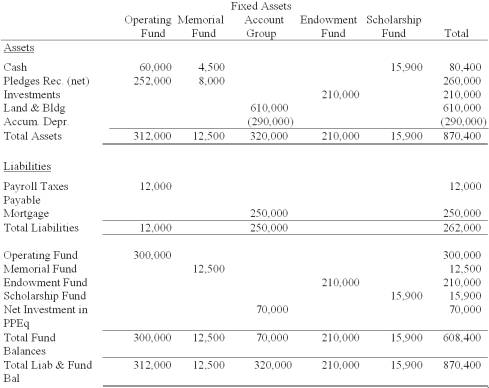

Union Seminary uses the fund basis of accounting for internal record keeping.Presented below is the fully adjusted 12/31/2012 balance sheet for Union,prepared using funds and account groups.The following are fund descriptions:

● Operating Fund - the fund used for transactions not falling within the definition of other funds.There are no restrictions on these resources.

● Memorial Fund - Used to account for resources donated from outside parties for specific capital additions.

● Endowment Fund - Assets received from an outside donor for permanent investment,only the earnings may be expended.

● Scholarship Fund - Cash set aside by the Seminary's governing board for use as scholarships and student aid.

● Fixed Assets Account Group - A record of the Seminary's fixed assets and long-term debt.

Required:

Prepare a Statement of Financial Position following the guidelines provided in FASB Statements 116 and 117 for private not-for-profits and assuming Union does not classify plant assets as temporarily restricted.

Definitions:

Pharmaceutical Company

A business involved in the research, development, manufacturing, and distribution of medications.

Self-Employment Income

Self-Employment Income refers to earnings derived from one’s own business, professional practice, or freelance work, as opposed to earning a salary or wages from an employer.

MACRS

The Modified Accelerated Cost Recovery System, a method of depreciation in the U.S. for tax purposes, allowing for accelerated asset expense deductions over time.

5-Year Property

Property that is classified under MACRS (Modified Accelerated Cost Recovery System) as having a recovery period of 5 years for depreciation purposes.

Q1: A Statement of Functional Expenses is required

Q4: The difference between assets and liabilities of

Q11: The FASB requires private not-for-profit organizations to

Q34: Which of the following accounts are used

Q40: Why are there different patterns of gender-related

Q43: Nicolas is about to enter puberty.All of

Q50: Unconditional promises to give are recognized when

Q55: For teens to develop critical thinking skills,they

Q73: Which of the following factors,if present,would indicate

Q89: In order to compute the interest coverage