Case Study Short Essay Examination Questions

Motorola Bows to Activist Pressure

Under pressure from activist investor Carl Icahn, Motorola felt compelled to make a dramatic move before its May 2008 shareholders' meeting. Icahn had submitted a slate of four directors to replace those up for reelection and demanded that the wireless handset and network manufacturer take actions to improve profitability. Shares of Motorola, which had a market value of $22 billion, had fallen more than 60% since October 2006, making the firm's board vulnerable in the proxy contest over director reelections.

Signaling its willingness to take dramatic action, Motorola announced on March 26, 2008, its intention to create two independent, publicly traded companies. The two new companies would consist of the firm's former Mobile Devices operation (including its Home Devices businesses consisting of modems and set-top boxes) and its Enterprise Mobility Solutions & Wireless Networks business. In addition to the planned spin-off, Motorola agreed to nominate two people supported by Carl Icahn to the firm's board. Originally scheduled for 2009, the breakup was postponed due to the upheaval in the financial markets that year. The breakup would result in a tax-free distribution to Motorola's shareholders, with shareholders receiving shares of the two independent and publicly traded firms.

The Mobile Devices business designs, manufactures, and sells mobile handsets globally, and it has lost more than $5 billion during the last three years. The Enterprise Mobility Solutions & Wireless Networks business manufactures, designs, and services public safety radios, handheld scanners and telecommunications network gear for businesses and government agencies and generates nearly all of the Motorola's current cash flow. This business also makes network equipment for wireless carriers such as Spring Nextel and Verizon Wireless.

By dividing the company in this manner, Motorola would separate its loss-generating Mobility Devices division from its other businesses. Although the third largest handset manufacturer globally, the handset business had been losing market share to Nokia and Samsung Electronics for years. Following the breakup, the Mobility Devices unit would be renamed Motorola Mobility, and the Enterprise Mobility Solutions & Networks operation would be called Motorola Solutions.

Motorola's board is seeking to ensure the financial viability of Motorola Mobility by eliminating its outstanding debt and through a cash infusion. To do so, Motorola intends to buy back nearly all of its outstanding $3.9 billion debt and to transfer as much as $4 billion in cash to Motorola Mobility. Furthermore, Motorola Solutions would assume responsibility for the pension obligations of Motorola Mobility. If Motorola Mobility were to be forced into bankruptcy shortly after the breakup, Motorola Solutions may be held legally responsible for some of the business's liabilities. The court would have to prove that Motorola had conveyed the Mobility Devices unit (renamed Motorola Mobility following the breakup) to its shareholders, fraudulently knowing that the unit's financial viability was problematic.

Once free of debt and other obligations and flush with cash, Motorola Mobility would be in a better position to make acquisitions and to develop new phones. It would also be more attractive as a takeover target. A stand-alone firm is unencumbered by intercompany relationships, including such things as administrative support or parts and services supplied by other areas of Motorola. Moreover, all liabilities and assets associated with the handset business already would have been identified, making it easier for a potential partner to value the business.

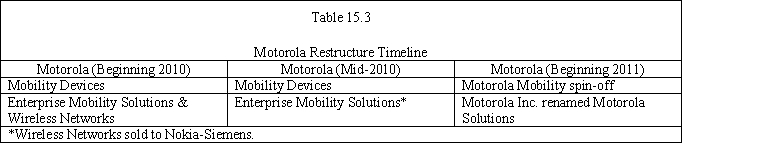

In mid-2010, Motorola Inc. announced that it had reached an agreement with Nokia Siemens Networks, a Finnish-German joint venture, to buy the wireless networks operations, formerly part of its Enterprise Mobility Solutions & Wireless Network Devices business for $1.2 billion. On January 4, 2011, Motorola Inc. spun off the common shares of Motorola Mobility it held as a tax-free dividend to its shareholders and renamed the firm Motorola Solutions. Each shareholder of record as of December 21, 2010, would receive one share of Motorola Mobility common for every eight shares of Motorola Inc. common stock they held. Table 15.3 shows the timeline of Motorola's restructuring effort.

1.In your judgment, did the breakup of Motorola make sense? Explain your answer.

2.What other restructuring alternatives could Motorola have pursued to increase shareholder value? Why do you believe it pursued this breakup strategy rather than some other option?

-Why did Kraft chose not to divest its grocery business,using the proceeds to either reinvest in its faster growing snack business,to buy back its stock,or a combination of the two?

Definitions:

Bank Service Charge

Fees charged by banks for various services provided to customers, such as account maintenance or transaction processing.

Deposits In Transit

Funds that have been deposited by a company but not yet recorded by the bank, resulting in a timing difference in the account balance.

Withdrawal

An act of taking money out of a business by the owner for personal use.

Credit Memorandum

A document issued by a seller that reduces the amount owed by a buyer, typically due to a return or refund.

Q2: A researcher decides to go to the

Q9: Why are groups compared in an experiment?<br>A)Because

Q22: Researchers need to be sensitive to labels.Assume

Q25: Which of the following are examples of

Q29: Parent firms with a high tax basis

Q63: Which of the following represent common components

Q80: While Kraft's share value did increase following

Q93: The justification for the adjusted present value

Q113: The parents estimate that the new company

Q120: A negative loan covenant is a portion