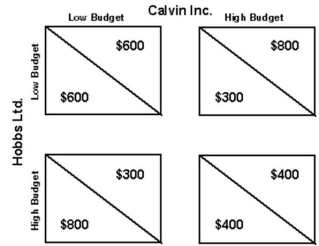

Below is a profit pay-off matrix for two oligopoly firms: Calvin Inc.and Hobbs Ltd.Calvin's profits are shown in the upper portion of each box and Hobb's are in the lower portion.

-Refer to the information above to answer this question.Which of the following statements is correct if no agreement between Calvin and Hobbs is in place and each is considering what to do in terms of its advertising budget?

Definitions:

Maturities

The set dates when the principal amount of a debt instrument, such as a bond, is due to be paid back to the investor.

Bond Prices

The market value of a bond, which inversely changes with interest rates.

Subordinated Debt

Debt with a lower priority for the payment of interest and principal than other (senior) debt.

Senior Debt

Senior debt is a loan or bond that takes priority over other unsecured or junior debt owed by the issuer.

Q3: Why is it important for a narrative

Q13: Reflexivity or self-disclosure by the researcher is

Q18: Which of the following issues regarding response

Q23: What is the form of a qualitative

Q40: Where is a monopolist's profit maximized?<br>A)At break-even

Q70: Where is a monopolist's profit maximized?<br>A)Where marginal

Q79: All of the following statements,except one,are correct

Q82: Suppose that the current price of oil

Q127: Table 10.2 shows the demand for Gamma,a

Q139: Which of the following statements is correct