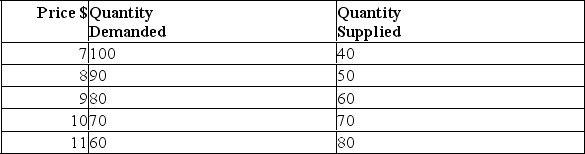

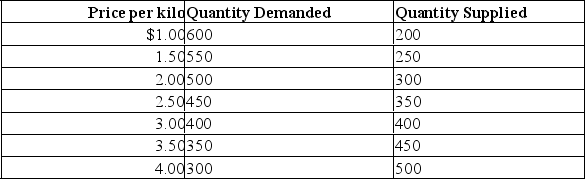

-The table below shows the market for fuji apples in the country of Westchester.

a)What is the equilibrium values of price and quantity? Suppose that the government imposes a price floor which is $0.50 different form the present equilibrium price.

a)What is the equilibrium values of price and quantity? Suppose that the government imposes a price floor which is $0.50 different form the present equilibrium price.

b)What is the resulting shortage/surplus? Suppose,instead that the government imposes a price ceiling that is $1 different from the present equilibrium price.

c)What would be the resulting shortage/surplus?

Definitions:

Section 1231 Property

Refers to a type of property, both tangible and depreciable, used in a business and held for more than one year, which qualifies for tax treatment that combines aspects of capital gains and ordinary income tax rates.

Trade or Business

Activity conducted for the purpose of earning income or profit, involving regular and continuous activities in a particular field.

Deemed Worthless

A term referring to assets that have become valueless and are recognized as a loss for tax purposes.

Long-Term Loss

A loss realized from the sale of an asset held for more than one year, which can offset long-term capital gains.

Q29: Explain the effects of a decrease in

Q33: If the demand for a product were

Q70: Each functional area is,in some way,involved in

Q71: Refer to Table 5.13 to answer this

Q92: (a)Calculate marginal costs,total costs,average fixed costs,average variable

Q95: Refer to the above information to answer

Q102: What is meant by producers' preference?<br>A)The effect

Q109: Complete the following table.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5692/.jpg" alt="Complete

Q112: Table 4.3 shows the market demand for

Q169: What might cause the MC curve to