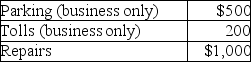

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2017.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year is $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year is $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Labor Supply Curve

A graphical illustration of the relationship between the wage rate and the quantity of labor workers are willing to supply at various wage rates.

Substitution Effect

The change in consumption patterns due to a change in the relative prices of goods, leading consumers to substitute one good for another.

Income Effect

The change in consumers' purchasing power and consequently the quantity demanded of a good or service, prompted by a change in real income.

Opportunity Cost

Missing the chance to profit from several alternative options by deciding on one.

Q25: Business investigation expenses incurred by a taxpayer

Q34: Carole owns 75% of Pet Foods,Inc.As CEO,Carole

Q44: An ordinary annuity can be defined as<br>A)a

Q65: Your gross wages are subject to FICA

Q67: Opportunity cost refers to<br>A)money needed for major

Q75: Discuss when expenses are deductible under the

Q76: Investments with a higher risk of default

Q107: Special documentation rules apply to donation of<br>A)motor

Q124: In the current year,Marcus reports the following

Q127: A personal property tax based on the