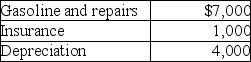

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use.The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Yield Management Pricing

Charging different prices to maximize revenue for a set amount of capacity at any given time.

Dynamic Pricing

The practice of changing prices for products and services in real time in response to supply and demand conditions.

Supply and Demand

Economic principles describing how the availability of goods (supply) and the desire for them (demand) affect their price.

Buzz Marketing

is a viral marketing strategy that focuses on maximizing the word-of-mouth potential of a campaign or product, often relying on unconventional interactions to stimulate discussions among consumers.

Q30: Which of the following conditions would generally

Q43: An accountant takes her client to a

Q48: Wilson Corporation granted an incentive stock option

Q51: If you are presented with an offer

Q51: If you do not have access to

Q55: A sole proprietor paid legal fees in

Q57: Which of the following is not an

Q61: Savings institutions differ from commercial banks in

Q78: Reductions of gross income for such items

Q89: Expenses incurred in a trade or business