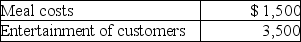

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Solomon Asch

A psychologist known for his research on conformity, demonstrating how group pressure can influence an individual to conform.

Familiarity Effect

A phenomenon where people tend to develop a preference for things merely because they are familiar with them.

Fundamental Attribution Error

The tendency to overemphasize personal characteristics and ignore situational factors in judging others' behavior.

Just-World Effect

The cognitive bias to believe that the world is fundamentally fair, leading people to rationalize an undeserved, negative experience by the victim.

Q30: Points paid to refinance a mortgage on

Q56: Brent must substantiate his travel and entertainment

Q57: Which of the following is not an

Q77: Which of the following is not an

Q116: Ron is a university professor who accepts

Q124: Which of the following statements is incorrect

Q132: Adjusted gross income (AGI)is the basis for

Q139: Which of the following is not required

Q141: Charles is a single person,age 35,with no

Q146: Chana purchased 400 shares of Tronco Corporation