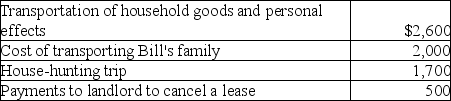

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Liquor Sales

The total volume or amount of alcoholic beverages sold within a given timeframe, often analyzed for economic or regulatory purposes.

Moving Averages

A statistical procedure used to analyze time series data by creating a series of averages of different subsets of the full data set.

Mattress Sales

Refers to the market or process involved in buying and selling mattresses, often evaluated in economic or business analyses.

Seasonal Pattern

A pattern in data that repeats itself at regular intervals due to seasonal factors.

Q2: In determining whether travel expenses are deductible,a

Q17: All of the following are true with

Q33: Material participation by a taxpayer in a

Q43: Kickbacks and bribes paid to federal officials

Q46: Interest rate changes are affected by the

Q51: An individual taxpayer has generated a net

Q66: Which of the following is not a

Q80: If a taxpayer makes a charitable contribution

Q100: Maria pays the following legal and accounting

Q118: Amy,a single individual and sole shareholder of