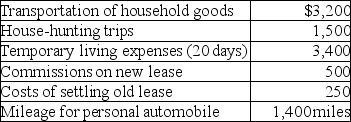

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Job Enrichment

A method of enhancing job satisfaction by adding more meaningful tasks to an employee's role to increase engagement and motivation.

Projection

In psychology, projection refers to the unconscious transfer of one's own desires or emotions to another person.

Networking

The act of creating and fostering a web of relationships valuable for mutual exchange, support, and professional growth.

Racial Stereotypes

Preconceived notions or generalizations about individuals based on their race, often leading to biases and discrimination.

Q31: FICA taxes include two components,which consist of<br>A)accident

Q35: Because they have lower expenses,Web-based financial institutions

Q46: An accrual-basis corporation can only deduct contributions

Q51: In order to have a safety deposit

Q64: In October 2017,Jonathon Remodeling Co. ,an accrual-method

Q69: In the case of casualty losses of

Q71: For charitable contribution purposes,capital gain property includes

Q75: Liabilities can be calculated by<br>A)adding assets plus

Q82: A taxpayer has low AGI this year,but

Q92: Tasneem,a single taxpayer has paid the following