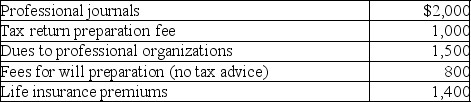

West's adjusted gross income was $90,000.During the current year he incurred and paid the following:  None of the expenses were reimbursed.Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

None of the expenses were reimbursed.Assuming he can itemize deductions,how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Definitions:

Investment Center Assets

Resources and assets managed within a business segment or division that is responsible for its own revenues, expenses, and investments, allowing for performance measurement.

Service Department Expenses

Costs incurred by the departments that support the production or operation departments but do not directly contribute to the production of goods.

Departmental Income Statements

Financial statements that report the revenues, costs, and income for individual departments within a company.

Investment Center Managers

Personnel responsible for overseeing an investment center, which is a division or unit within an organization judged on its profitability and return on investment.

Q24: All interest and dividends received by an

Q26: If an NOL is incurred,when would a

Q43: Jorge contributes $35,000 to his church and

Q61: Money market funds invest mainly in _,which

Q66: Which of the following is deductible as

Q68: All of the following are true of

Q81: Aretha has AGI of less than $100,000

Q83: Partnerships and S corporations must classify their

Q91: Deposits at commercial banks are insured up

Q124: In the current year,Marcus reports the following