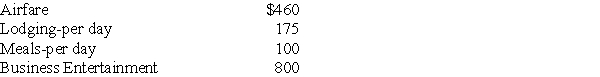

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Definitions:

Beverage Mixers

Equipment or substances designed to mix drinks, either alcoholic or non-alcoholic, to create consistent and well-blended beverages.

Idle Time

The period during which resources, such as machinery or labor, are not being used productively in the manufacturing process.

Cycle Time

Duration required to complete one cycle of an operation or process, often measured to identify efficiency improvements.

Battery-Powered

Devices or vehicles that operate using electricity stored in batteries as their primary source of energy.

Q8: Long-term liabilities are debts that will be

Q11: If you save the same dollar amount

Q22: Carol would like to have $500,000 saved

Q49: Discuss what circumstances must be met for

Q73: Assessments or fees imposed by the government

Q81: You have a choice between investing $10,000

Q89: All of the following are deductible as

Q118: Carl purchased a machine for use in

Q120: All taxpayers are allowed to contribute funds

Q135: Under the accrual method,recurring liabilities may be