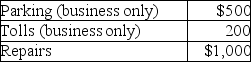

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2017.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year is $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year is $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Selling Price

The amount of money for which a product or service is offered for sale to consumers.

Risks

The potential for losing something of value, which can be financial, physical, emotional, or otherwise, as a result of actions taken or events that occur.

Ownership

The state or fact of exclusive rights and control over property, which can be an object, land/real estate, intellectual property, or some form of rights to assets.

Benefits

Forms of value, other than payment, provided to employees in return for their contribution to the organization, such as healthcare, pensions, and leave entitlements.

Q26: Cashier's checks,money orders,and traveler's checks are secured

Q42: All of the following payments for medical

Q68: If prepared properly,financial plans are set for

Q72: A(n)_ card allows you to pay for

Q73: Your current liquidity ratio is 2.0.If you

Q74: Taxpayers may not deduct interest expense on

Q81: Which of the following is not a

Q88: Interest income would come from earnings on<br>A)stocks.<br>B)savings

Q99: Investment interest expense is deductible when incurred

Q117: Distinguish between the accrual-method taxpayer and the