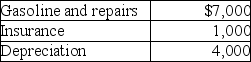

Rajiv,a self-employed consultant,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use.The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs.Rajiv has used the actual cost method in the past.What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Rajiv's AGI is $100,000 before considering the auto costs.Rajiv has used the actual cost method in the past.What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Q2: You wish to retire in 30 years

Q7: A sole proprietor will not be allowed

Q16: Educational expenses incurred by a bookkeeper for

Q17: Fees paid to prepare a taxpayer's Schedule

Q39: A complete financial plan consists of budgeting,taxes,financing,and

Q43: Interest expense paid on home loans and

Q59: Kayla reported the following amounts in her

Q67: Which of the following is not required

Q70: Valeria owns a home worth $1,400,000,with a

Q83: Generally,savings account yields are _ than certificates