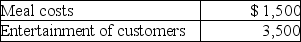

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Fixed Prices

Prices that do not change in response to market conditions.

Corporate Taxes

Government levies placed on the earnings or profits of businesses.

Economic Environment

The total of economic factors, such as employment, income distribution, and investment opportunities, that influence the behavior of consumers and businesses.

Smoot-Hawley

Refers to the Smoot-Hawley Tariff Act of 1930, which raised U.S. import tariffs on thousands of goods, leading to significant trade reductions worldwide.

Q9: Jack takes a $7,000 distribution from his

Q27: The maximum tax deductible contribution to a

Q32: A company maintains a qualified pension plan

Q41: All of the following are true of

Q48: Everything else being equal,the _ the interest

Q77: Dana paid $13,000 of investment interest expense

Q82: Taxpayers may use the standard mileage rate

Q93: During 2017,Marcia,who is single and is covered

Q127: In a contributory defined contribution pension plan,all

Q136: Interest expense on debt incurred to purchase