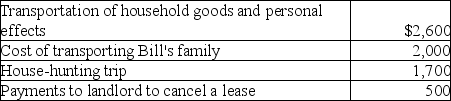

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Surviving Spouse

A surviving spouse is the husband or wife left alive after the other has passed away.

Express Trusts

A type of trust explicitly created by a settlor, typically in writing, specifying the trust's terms, beneficiaries, and the trustee's duties.

Trust Instruments

Legal documents establishing a trust, specifying its terms, and the responsibilities of the trustees.

Personal Representative

The person designated by a testator to collect the testator’s property after he or she dies, pay the debts and taxes, and make sure the remainder of the estate gets distributed.

Q6: Characteristics of profit-sharing plans include all of

Q17: The concept that a dollar received today

Q27: During his _ your Uncle Harvey decides

Q31: Information can be easily found on Web

Q40: You utilize present and future value concepts

Q41: Gambling losses are miscellaneous itemized deductions subject

Q48: The best measure of a person's or

Q49: The Super Bowl is played in Tasha's

Q63: _ and _ are both reported on

Q71: Which of the following is not an