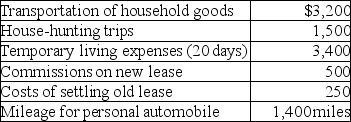

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Royalties

Payments from the licensee to the licenser consisting of a percentage of what is earned from selling such products and services.

Intellectual Infrastructure

Encompasses the knowledge resources, institutions, and networks that support the creation, dissemination, and utilization of information and innovation.

Technological Factor

Technological factor relates to the impact that advancements and innovations in technology have on a business's operations, strategies, and competitiveness in the marketplace.

Internal Management

The administration and organization of a company's internal affairs, including human resources, operations, and policies.

Q1: The sale of inventory at a loss

Q3: In 2017 the IRS audits a company's

Q31: Hui pays self-employment tax on her sole

Q44: An ordinary annuity can be defined as<br>A)a

Q44: Feng,a single 40-year-old lawyer,is covered by a

Q51: Patrick and Belinda have a twelve-year-old son,Aidan,who

Q61: Qualified residence interest consists of both acquisition

Q68: If your monthly disposable income equals $1,500

Q123: The destruction of a capital asset due

Q137: At her employer's request,Kim moves from Albany