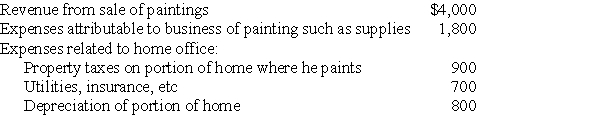

Dighi,an artist,uses a room in his home (250 square feet)as a studio exclusively to paint.The studio meets the requirements for a home office deduction.(Painting is considered his trade or business. )The following information appears in Dighi's records:

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law,how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill.How much of a home office deduction,if any,will he be allowed?

Definitions:

Employee Empowerment

The practice of giving employees the authority, tools, and resources to make decisions and contribute to the company's success.

Recruiting Focus

Strategies or priorities set by an organization for attracting and hiring the best possible talent.

Technical Skills

The abilities and knowledge needed to perform specific tasks, often related to IT, engineering, or other specialized fields.

Total Quality Management

A comprehensive management approach focusing on continuous improvement in all organizational processes, products, and services.

Q3: Which of the following is not a

Q17: When applying the limitations of the passive

Q28: Which of the following decisions would involve

Q29: David's liquidity ratio is 3.0.He has $1,000

Q39: Losses on sales of property between a

Q54: It is better to spend your money

Q61: _ allows access to funds to cover

Q90: Frank loaned Emma $5,000 in 2015 with

Q92: Medicare taxes are 1.45% of your salary,regardless

Q95: Discuss the tax treatment of a nonqualified