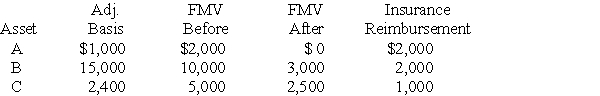

Wes owned a business which was destroyed by fire in May 2017.Details of his losses follow:

His AGI without consideration of the casualty is $45,000.

His AGI without consideration of the casualty is $45,000.

What is Wes's net casualty loss deduction for 2017?

Definitions:

Track the Brand's Performance

Refers to the process of measuring and evaluating the success and progress of a brand over time in the market.

Quantitative Research

A research methodology focused on obtaining and analyzing numerical data to derive insights and patterns about a subject matter.

Measure Differences

The process of evaluating and quantifying variations or disparities, often used in research to compare groups or conditions.

Interesting Stories

Narratives or accounts that are engaging and compelling, capturing the attention of the audience.

Q10: When money accumulates interest,it is said to

Q11: After your financial plan is developed it

Q16: A passive activity includes any rental activity

Q50: Personal finance does not include the process

Q54: Trista,a taxpayer in the 33% marginal tax

Q56: One of the requirements which must be

Q100: Sam retired last year and will receive

Q109: Which of the following individuals is not

Q114: Nondiscrimination requirements do not apply to working

Q122: A taxpayer can deduct a reasonable amount