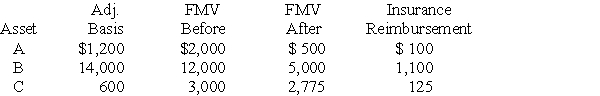

Determine the net deductible casualty loss on Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2017 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal-use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Heart Failure

A chronic condition in which the heart is unable to pump blood effectively to meet the body's needs.

Active Motion

Movement initiated and performed by an individual without assistance, reflecting the range of motion and strength of muscles and joints.

Slight Weakness

A minor or mild loss of strength in one or more muscles, not typically indicative of a serious condition.

ROM

Range of Motion; the full movement potential of a joint, usually its range of flexion and extension.

Q11: Martin Corporation granted a nonqualified stock option

Q32: Balance sheet assets should be valued at<br>A)original

Q33: If your net cash inflows exceed your

Q42: Self-employed individuals may claim,as a deduction for

Q62: Which of the following situations will disqualify

Q67: In order to maximize the use of

Q71: An employee travels out of town for

Q72: The maximum tax deductible contribution to a

Q74: To compute how much you would need

Q143: Gayle,a doctor with significant investments in the