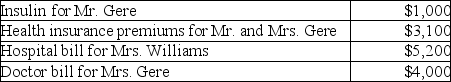

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

IFRS

A collection of accounting guidelines formulated by the International Accounting Standards Board (IASB) to assist in the creation of financial statements for public companies worldwide, known as International Financial Reporting Standards.

Installment Sales

A sales method that allows customers to pay for goods or services over a period of time in installments.

Critical Event

A significant occurrence that has a profound impact on an entity's operations or financial performance, necessitating special consideration in accounting and financial reporting.

Measurability Conditions

Criteria that determine when revenue can be recognized in the accounting process, ensuring it can be reliably measured.

Q23: During the current year,Martin purchases undeveloped land

Q25: Business investigation expenses incurred by a taxpayer

Q30: The income in your budget is not

Q30: Points paid to refinance a mortgage on

Q45: All of the following fringe benefits paid

Q47: Which of the following is true about

Q79: In September of 2017,Michelle sold shares of

Q81: Aretha has AGI of less than $100,000

Q99: Investment interest expense is deductible when incurred

Q134: Pamela was an officer in Green Restaurant