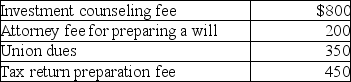

Daniel had adjusted gross income of $60,000,which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations.His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

Definitions:

Chain Referral

A sampling method where existing study subjects recruit future subjects from among their acquaintances.

Quota Sampling

a market research technique that involves selectively collecting samples from a specific subset of a population, ensuring representation based on characteristics.

Initial Discovery

The first stage of research or inquiry where a new idea, phenomenon, or piece of information is identified.

Research

The systematic investigation into and study of materials and sources in order to establish facts and reach new conclusions.

Q10: Greg is the owner and beneficiary of

Q11: Martin Corporation granted a nonqualified stock option

Q34: The wages that you forego when you

Q39: Ted pays $2,100 interest on his automobile

Q72: Which one of the following is a

Q76: Retirement planning should take place<br>A)when you retire.<br>B)shortly

Q91: The vacation home limitations of Section 280A

Q103: Charles is a self-employed CPA who maintains

Q112: If the stock received as a nontaxable

Q125: In-home office expenses for an office used