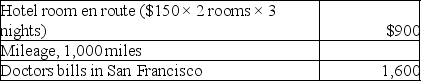

In 2017,Sela traveled from her home in Flagstaff to San Francisco to seek specialized medical care.Because she was unable to travel alone,her father accompanied her.Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

Definitions:

Progressive

Describes policies or ideologies favoring social reform, innovation, and gradual improvements over time, often in the context of taxation, societal change, or politics.

Regressive

Refers to policies or measures that disproportionately affect those with lower incomes, often making them bear a larger relative burden.

Proportional

A relationship between two quantities where the ratio remains constant.

Payroll Taxes

Charges assessed on employers and their workers, based on a percentage of the compensation paid to employees.

Q2: A taxpayer reports capital gains and losses

Q5: Jeff has a $1,000 salary and a

Q28: Michelle purchased her home for $150,000,and subsequently

Q40: Detecting future cash flow overages and deficiencies

Q50: A taxpayer may avoid tax on income

Q63: Cash outflows are also called<br>A)assets.<br>B)expenses.<br>C)income.<br>D)liabilities.

Q69: On July 1 of the current year,Marcia

Q71: Which of the following is not a

Q108: John,an employee of a manufacturing company,suffered a

Q136: Normally,a security dealer reports ordinary income on