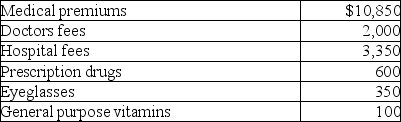

Mitzi's medical expenses include the following:  Mitzi's AGI for the year is $33,000.She is single and age 49.None of the medical costs are reimbursed by insurance.After considering the AGI floor,Mitzi's medical expense deduction is

Mitzi's AGI for the year is $33,000.She is single and age 49.None of the medical costs are reimbursed by insurance.After considering the AGI floor,Mitzi's medical expense deduction is

Definitions:

Interest Rates

The cost of borrowing money or the return on investment for savings and loans, expressed as a percentage.

Government Outlays

The total expenditures made by the government, including spending on goods and services, transfer payments, and interest on debt.

Government Revenues

The income received by the government from taxes and non-tax sources used to fund public services and expenditures.

Interest Rates

The rate at which a borrower is charged interest for borrowing money from a lender.

Q7: After he was denied a promotion,Daniel sued

Q16: Which of the following will not increase

Q38: Losses are generally deductible if incurred in

Q38: Deductible moving expenses include the cost of

Q39: A complete financial plan consists of budgeting,taxes,financing,and

Q46: Travel expenses related to temporary work assignments

Q46: Awards for emotional distress attributable to a

Q81: Which of the following is not a

Q94: Tucker (age 52)and Elizabeth (age 48)are a

Q118: Victor,a calendar-year taxpayer,owns 100 shares of AB