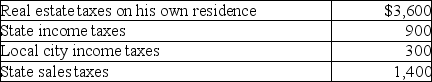

Matt paid the following taxes this year:  What is the maximum amount Matt can deduct as an itemized deduction on his tax return?

What is the maximum amount Matt can deduct as an itemized deduction on his tax return?

Definitions:

Contingency

The specified relationship between a specific behavior and reinforcement

Conditioning

Conditioning is a process in psychology in which a response becomes more frequent or more predictable in a given environment due to reinforcement.

Behavioral Contrast

A phenomenon in operant conditioning where the rate of response to one stimulus changes when the reinforcement conditions are modified for another stimulus.

Congruency Effect

A phenomenon where the reaction time is faster and accuracy is higher when the properties of a stimulus are in harmony with its response.

Q8: Mr.Dennis purchased a machine for use in

Q8: In 2017,Sean,who is single and age 44,received

Q11: If a taxpayer suffers a loss attributable

Q20: For the years 2013 through 2017 (inclusive)Mary,a

Q36: Daniel has accepted a new job and

Q40: A thorough understanding of this personal finance

Q64: Foreign real property taxes and foreign income

Q70: When the taxpayer anticipates a full recovery

Q70: What factors are considered in determining whether

Q101: Tyler (age 50)and Connie (age 48)are a