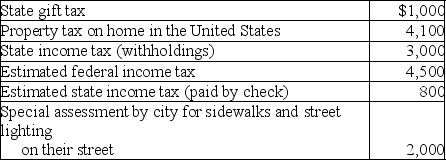

During the year Jason and Kristi,cash-basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Health

A state of complete physical, mental, and social well-being, not merely the absence of disease or infirmity.

Well-Being

The state of being comfortable, healthy, or happy, encompassing both physical and mental health and general life satisfaction.

Dieting Behavior

The intentional control or regulation of food intake to achieve or maintain a desired weight.

Weight Problems

Issues related to being over or underweight, affecting one's health or well-being.

Q25: Educational expenses incurred by a CPA for

Q51: If both a husband and wife are

Q81: During the current year,Ivan begins construction of

Q103: Bev has one daughter and three grandchildren.Bev

Q109: Jade is a single taxpayer in the

Q109: In 2016,Grace loaned her friend Paula $12,000

Q110: While payments received because a person has

Q126: If an individual taxpayer's net long-term capital

Q137: At her employer's request,Kim moves from Albany

Q138: Renee is single and has taxable income