Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

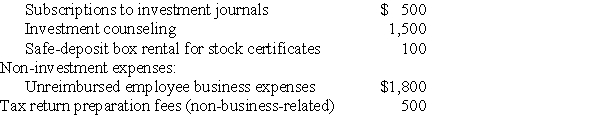

Investment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Annual Sales

The total revenue generated from the sale of goods or services in one fiscal year.

Variable Expenses Per Unit

Costs that vary directly with the level of production or sales volume, such as raw materials and direct labor costs per unit.

Fixed Expenses

Costs that do not vary with the level of production or sales, such as rent, insurance, and salaries, providing predictability in budgeting.

Break-even

The point at which total costs equal total revenues, meaning there is no profit or loss.

Q10: Under the wash sale rule,if all of

Q14: Pat,an insurance executive,contributed $1,000,000 to the reelection

Q21: Exter Company is experiencing financial difficulties.It has

Q31: Liquidity cannot be enhanced using sound money

Q32: Douglas and Julie are a married couple

Q37: Andrea died with an unused capital loss

Q37: Which of the following is an example

Q42: Jillian has just accepted an offer from

Q112: Julia suffered a severe stroke and has

Q122: Gwen traveled to New York City on