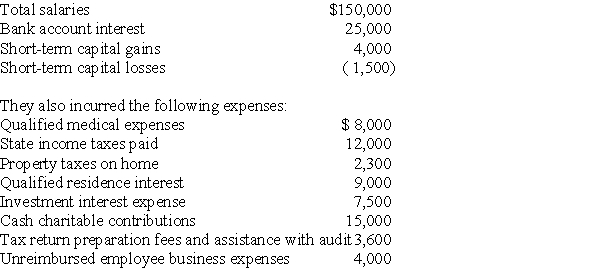

During 2017,Richard and Denisa,who are married and have two dependent children,have the following income and losses:

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form. )

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form. )

Definitions:

Federal Reserve's Monetary

Actions by the Federal Reserve to control the money supply and interest rates in an effort to regulate the economy.

Real Output

The quantity of goods and services produced, adjusted for inflation, reflecting the true productivity of an economy.

Economic Growth

An increase in the output of goods and services in an economy over time, often measured as the percent rate of increase in real GDP.

Adjustable Rate Mortgages

A mortgage where the interest rate on the remaining balance changes over the duration of the loan.

Q9: Deductions for AGI may be located<br>A)on the

Q14: Except in the case of qualifying accelerated

Q20: Ellen,a CPA,prepares a tax return for Frank,a

Q37: Andrea died with an unused capital loss

Q41: During the current year,Jack personally uses his

Q47: Beth and Sajiv,a married couple,earned AGI of

Q75: Tia is a 52-year-old,unmarried taxpayer who is

Q82: A taxpayer has low AGI this year,but

Q87: When personal-use property is covered by insurance,no

Q142: Which of the following factors is important