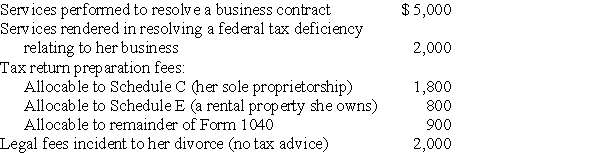

During the current year,Lucy,who has a sole proprietorship,pays legal and accounting fees for the following:

What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Hidden Information

Data or content not readily visible or accessible in a document, website, or software, often requiring special actions to view.

File Trait

A file trait refers to a characteristic or property that defines aspects of a file, such as its format, size, or permissions.

Identifying Information

Data that can uniquely identify an individual, such as name, social security number, or address.

Variants

Different forms or versions of something, typically allowing for customization or adjustments to suit different preferences or conditions.

Q16: A passive activity includes any rental activity

Q22: A deduction will be allowed for an

Q41: Speak Corporation,a calendar-year,cash-basis taxpayer,sells packages of foreign

Q43: Under the economist's definition,unrealized gains,as well as

Q45: All of the following fringe benefits paid

Q54: Bart owns 100% of the stock of

Q69: In the case of casualty losses of

Q81: In-home office expenses are deductible if the

Q91: When both borrowed and owned funds are

Q97: Loan proceeds are taxable in the year