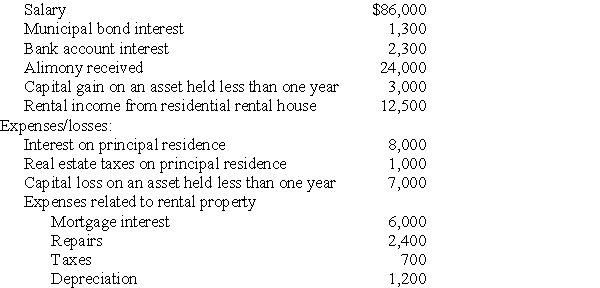

During the current year,Donna,a single taxpayer,reports the following items of income and expenses:

Income:

Compute Donna's taxable income.(Show all calculations in good form. )

Compute Donna's taxable income.(Show all calculations in good form. )

Definitions:

Receivables Balance

The complete amount of financial liabilities customers hold towards a company for supplied goods or services awaiting payment.

Accounts Receivable Period

The amount of time it takes for a company to collect payment from its customers after a sale has been made.

Cost of Goods Sold

Represents the direct costs attributable to the production of the goods sold by a company.

Q10: Under the wash sale rule,if all of

Q10: Greg is the owner and beneficiary of

Q36: An individual is considered terminally ill for

Q37: Expenses paid with a credit card are

Q51: Austin incurs $3,600 for business meals while

Q52: Under the tax concept of income,all realized

Q53: Wes owned a business which was destroyed

Q59: Kayla reported the following amounts in her

Q66: Sam received a scholarship for room and

Q92: Laura,the controlling shareholder and an employee of