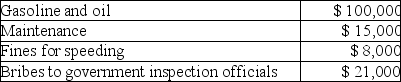

Jimmy owns a trucking business.During the current year he incurred the following:  The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordinary in the industry.What is the total amount of deductible expenses?

The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordinary in the industry.What is the total amount of deductible expenses?

Definitions:

Organization Performance

A measure of the efficiency and effectiveness of a company based on criteria such as profitability, revenue, and customer satisfaction.

Employee Stock Ownership Plan

A program that gives employees ownership interest in the company through stock ownership, often used as a corporate finance strategy.

Incentive Plan

A structured program designed to motivate and compensate employees beyond their regular paychecks, often based on performance, productivity, or achieving specific goals.

Stock Ownership Plans

Employee benefit plans that give workers ownership interest in the company through the acquisition of stock, often aimed at improving employee motivation and performance.

Q21: Exter Company is experiencing financial difficulties.It has

Q25: Business investigation expenses incurred by a taxpayer

Q27: During his _ your Uncle Harvey decides

Q27: Tom and Shawn own all of the

Q54: Alex is a self-employed dentist who operates

Q63: Adam purchased stock in 2006 for $100,000.He

Q69: In the case of casualty losses of

Q121: An electrician completes a rewiring job and

Q131: When a public school system requires advanced

Q140: A qualified pension plan requires that employer-provided