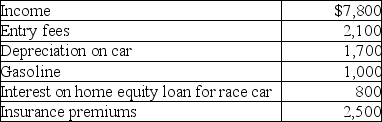

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Q5: In order to be treated as alimony

Q30: What is or are the standards that

Q32: During the year,Cathy received the following: •

Q39: Pat is a sales representative for a

Q46: Ryan and Edith file a joint return

Q49: Jackson Corporation granted an incentive stock option

Q68: Don's records contain the following information: 1.Donated

Q108: Tanya is considering whether to rollover her

Q118: Allison buys equipment and pays cash of

Q120: Courtney sells a cottage at the lake