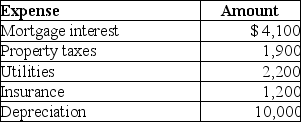

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:  Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Definitions:

Numerical Data

Information represented in numbers, often used in statistical, scientific, and mathematical analysis.

Chart

A visual representation of data designed to make complex information easily understandable at a glance.

Picture Style

A pre-defined set of adjustments or a filter applied to photos to achieve a specific look or effect, often used in photography and imaging software.

SHIFT+TAB

A keyboard shortcut used to navigate backwards through the elements of a GUI or text fields in documents.

Q9: In 2015 Bonnie,a sole proprietor,loaned her employee,John,$10,000

Q13: Which of the following is not generally

Q32: Joy reports the following income and loss:

Q69: Riva borrows $10,000 that she intends to

Q70: Amber supports four individuals: Erin,her stepdaughter,who lives

Q112: One of the requirements which must be

Q113: Gertie has a NSTCL of $9,000 and

Q119: A child credit is a partially refundable

Q126: Refundable tax credits are allowed to reduce

Q131: A cash-basis taxpayer can defer income recognition