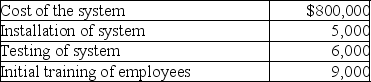

Terra Corp.purchased a new enterprise software system and incurred the following costs:  What is Terra Corp.'s basis in the software system?

What is Terra Corp.'s basis in the software system?

Definitions:

Cash Receipts Journal

A dedicated financial journal that tracks all cash inflows to a business, detailing the source and amount of cash received.

Cash Sales

Transactions where payment is made in cash at the time of the sale.

Cash from Sale

The cash received from selling goods or services.

Cash Receipts Journal

A financial journal that records all cash transactions, including sales and received payments, entering a business.

Q1: Julia provides more than 50 percent of

Q3: Distributions in excess of a corporation's current

Q13: Expenditures which do not add to the

Q53: Sheryl is a single taxpayer with a

Q65: Frank is a self-employed CPA whose 2017

Q85: An individual who is claimed as a

Q93: Olivia,a single taxpayer,has AGI of $280,000 which

Q124: If property that qualifies as a taxpayer's

Q128: Jacob,who is single,paid educational expenses of $16,000

Q144: Hunter retired last year and will receive