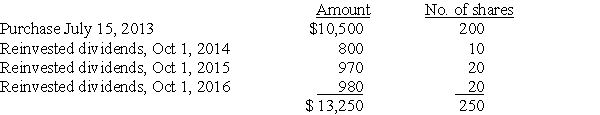

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2013,for $10,500,and has been reinvesting dividends.On December 15,2017,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Definitions:

Health Club

A facility offering health and fitness-related services such as exercise equipment, classes, and personal training.

Majority Vote

A voting outcome that is reached when more than half of the votes cast are in favor of a proposal or candidate.

Unanimous Vote

A voting outcome where all members of a decision-making body agree and vote the same way on a proposal.

Majority Vote

A decision-making process where more than half of the members of a group must agree on a proposition for it to be accepted or passed.

Q6: Which of the following statements is false?<br>A)Under

Q45: All of the following fringe benefits paid

Q52: What must an individual taxpayer prove to

Q52: Medical expenses incurred on behalf of children

Q52: Discuss reasons why a married couple may

Q63: A taxpayer has made substantial donations of

Q92: Ivan Trent,age five,receive $2,900 of dividends per

Q95: In 2000,Michael purchased land for $100,000.Over the

Q99: Cheryl is claimed as a dependent on

Q141: Charles is a single person,age 35,with no