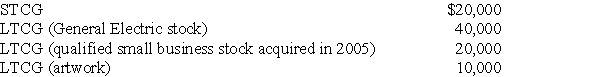

Tina,whose marginal tax rate is 33%,has the following capital gains this year:

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Definitions:

Equity

The value of ownership interest in a company, represented by the shares held by investors.

Depreciation Expense

An accounting method that allocates the cost of a tangible asset over its useful life, representing the wear and tear, deterioration, or obsolescence of the asset.

Q13: Expenditures which do not add to the

Q16: If a medical expense reimbursement is received

Q45: All of the following fringe benefits paid

Q70: Valeria owns a home worth $1,400,000,with a

Q78: When are points paid on a loan

Q81: Explain why interest expense on investments is

Q87: A sole proprietor contributes to the election

Q99: All recognized gains and losses must eventually

Q108: Tom and Heidi,husband and wife,file separate returns.Tom

Q126: Buzz is a successful college basketball coach.In