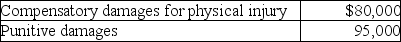

Derrick was in an automobile accident while he was going to work.The doctor advised him to stay home for eight months due to his physical injuries.The resulting lawsuit was settled and Derrick received the following amounts:  How much of the settlement must Derrick include in ordinary income on his tax return?

How much of the settlement must Derrick include in ordinary income on his tax return?

Definitions:

Statute

A written law enacted by a legislature under its constitutional lawmaking authority.

Sixth Amendment

An amendment to the U.S. Constitution guaranteeing accused persons rights in criminal proceedings, such as the right to a speedy trial and legal counsel.

Indictment

A charge or written accusation, issued by a grand jury, that probable cause exists to believe that a person has committed a crime for which he or she should stand trial.

Due Process

A fundamental constitutional guarantee that all legal proceedings will be fair, respecting all provided legal rights.

Q11: Lewis,who is single,is claimed as a dependent

Q19: Mike won $700 in a football pool.This

Q32: Which of the following characteristics belong(s)to the

Q59: Common examples of the Pension Model include

Q73: Carla redeemed EE bonds which qualify for

Q77: Many exclusions exist due to the benevolence

Q81: Josh purchases a personal residence for $278,000

Q102: To qualify as an abandoned spouse,the taxpayer

Q105: Felice is in the hotel management field.She

Q121: An electrician completes a rewiring job and