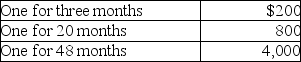

CT Computer Corporation,an accrual-basis taxpayer,sells service contracts on the computers it sells.At the beginning of January of this year,CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

Definitions:

Legal and Ethical Concepts

Fundamental principles and values in law and morality that guide behaviors and decision-making in society and professions.

Scope of Practice

The procedures, actions, and processes that a healthcare practitioner is permitted to undertake in keeping with the terms of their professional license.

Clinical Skill

The ability to perform actions or tasks effectively in a healthcare setting, which requires specific knowledge, expertise, and technique.

Patient Screenings

The process of testing or evaluating an individual for the presence of diseases or conditions in a healthcare setting.

Q7: After he was denied a promotion,Daniel sued

Q12: A partnership sells equipment and recognizes depreciation

Q18: Jonathon,age 50 and in good health,withdrew $6,000

Q36: Examples of the Exempt Model include deductible

Q38: Leigh pays the following legal and accounting

Q44: Given that D<sub>n</sub> is the amount of

Q62: Itemized deductions are deductions for AGI.

Q100: The portion of a taxpayer's wages that

Q104: Dustin purchased 50 shares of Short Corporation

Q137: With some exceptions,amounts withdrawn from a pension