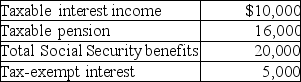

Mr.& Mrs.Tsayong are both over 66 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

Definitions:

Orbicularis Oculi

A muscle surrounding the eye, responsible for closing the eyelids and enabling blinking and winking.

Inferior Oblique

A muscle in the orbit of the eye that contributes to lateral rotation and elevation of the eyeball.

Eyeball Movement

The motion of the eyes, controlled by the ocular muscles, allowing for visual tracking and focusing.

Fibrous Tunic

The outermost layer of the eye, consisting of the sclera and cornea, it serves to protect the eye and maintain its shape.

Q13: Carter dies on January 1,2017.A joint return

Q27: The oldest age at which the "Kiddie

Q30: An accrual-basis taxpayer receives advance payment for

Q38: Nontax issues to consider when evaluating current

Q40: Earl invests $7,000 in a tax-exempt bond

Q76: This year,Lauren sold several shares of stock

Q86: Hildi and Frank have decided to form

Q103: Bev has one daughter and three grandchildren.Bev

Q105: Fines and penalties are tax deductible if

Q132: Torrie and Laura form a partnership in