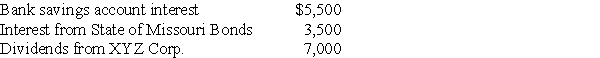

Kevin is a single person who earns $70,000 in salary for 2017 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2016 tax returns in April 2017.His federal refund was $600 and his state refund was $300.Kevin deducted his state taxes paid in 2016 as an itemized deduction on his 2016 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2017 return.

Kevin received tax refunds when he filed his 2016 tax returns in April 2017.His federal refund was $600 and his state refund was $300.Kevin deducted his state taxes paid in 2016 as an itemized deduction on his 2016 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2017 return.

Compute Kevin's taxable income for 2017.

Definitions:

Obedience

The act of following orders, rules, or requests from someone in authority, demonstrating compliance and submission.

Theory X

A management theory suggesting that employees are inherently lazy and will avoid work if they can, hence need to be closely supervised and have a structured work environment.

Internal Rewards

are personal satisfactions or fulfilments that come from within an individual, often as a result of accomplishing something.

External Rewards

Benefits or incentives provided by an external source, such as money, grades, or praise, which motivate behavior.

Q8: Danielle transfers land with a $100,000 FMV

Q15: On January 1 of this year (assume

Q15: David,age 62,retires and receives $1,000 per month

Q32: A partnership's liabilities have increased by year-end.As

Q48: For purposes of the dependency exemption,a qualifying

Q65: Major Corporation's taxable income for the current

Q68: Child support is<br>A)deductible by both the payor

Q78: The term "thin capitalization" means that the

Q90: John,who is President and CEO of ZZZ

Q141: An individual buys 200 shares of General