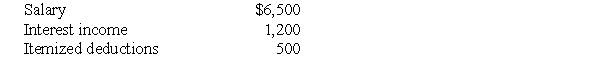

The following information for 2017 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Definitions:

Secondary Effects

The indirect impacts of an economic event, policy, or decision that may occur as a consequence of the primary effect, affecting different sectors or parts of the economy.

Economics

The social science that studies how individuals, governments, and societies make choices regarding the allocation of limited resources to satisfy unlimited wants.

Nobel Prize

Prestigious international awards granted annually in several categories including Physics, Chemistry, Medicine, Literature, and Peace, recognizing significant contributions to humanity.

Social Science

The field of scholarly or scientific study that examines society and human behaviors in various contexts.

Q2: A single taxpayer earns a salary of

Q11: As a result of a divorce,Matthew pays

Q20: Which regulation deals with the gift tax?<br>A)Reg.Sec.1.165-5<br>B)Reg.Sec.20.2014-5<br>C)Reg.Sec.25.2518-5<br>D)Reg.Sec.301.7002-5

Q31: If Houston Printing Co.purchases a new printing

Q75: While certain income of a minor is

Q85: Unused charitable contributions of a corporation are

Q100: Jamahl has a 65% interest in a

Q110: All of the following items are included

Q126: If an individual taxpayer's net long-term capital

Q131: Individuals Bert and Tariq form Shark Corporation.Bert