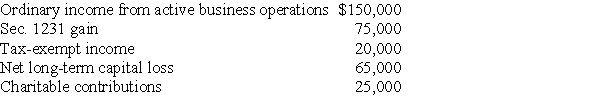

The AAA Partnership makes an election to be an Electing Large Partnership.The partnership reports the following activities:

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

Definitions:

Differential Association

A theory in criminology that posits individuals learn deviant behavior through interaction with others, emphasizing the role of social relationships in the acquisition of deviance.

Differential Association Theory

A criminological theory suggesting that individuals learn deviant behavior through their interactions and associations with others.

Rewards

Benefits, often in the form of money, gifts, or recognition, given for performing certain tasks or behaviors aimed at achieving desired outcomes.

Consequences

The outcomes or effects that follow from an action or decision.

Q12: A partnership sells equipment and recognizes depreciation

Q40: Tonya is the 100% shareholder of a

Q48: For purposes of the dependency exemption,a qualifying

Q68: In computing AMTI,adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either added

Q76: Jan purchased an antique desk at auction.For

Q86: Hildi and Frank have decided to form

Q91: Tyne is single and has AGI of

Q120: A partnership is generally required to use

Q131: A credit is available to encourage employers

Q132: Liz and Bert divorce and Liz receives