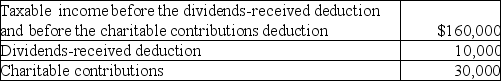

Witte Corporation reported the following results for the current year:  What is the amount of the charitable contribution carryover to next year?

What is the amount of the charitable contribution carryover to next year?

Definitions:

Market Audit

An in-depth and systematic examination of a market to understand its dynamics, trends, and opportunities.

Formal Route Designs

Predetermined, structured paths or plans designed for logistical purposes, often in the context of distribution or transportation.

Promotional Costs

Expenses associated with marketing and advertising efforts to boost sales or brand visibility.

Territory Disagreements

Conflicts that arise over the boundaries, control, or ownership of geographical or market areas.

Q19: The difference between the BTRORs of fully-taxable

Q25: Jorge has $150,000 of self-employment earnings from

Q25: John contributes land having $110,000 FMV and

Q43: Total Corporation has earned $75,000 current E&P

Q45: In all situations,tax considerations are of primary

Q46: If t<sub>0</sub> is the tax rate in

Q88: Partnerships,limited liability partnerships,limited liability companies,and C corporations

Q101: Individuals Terry and Jim form TJ Corporation.Terry

Q101: When capital or Sec.1231 assets are transferred

Q130: Jing,who is single,paid educational expenses of $16,000