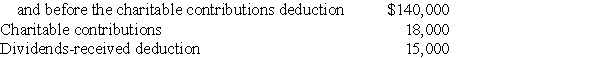

Hazel Corporation reported the following results for the current year:

Taxable income before the dividends-received deduction

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryforward to next year?

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryforward to next year?

Definitions:

Retirement Income

The amount of money or income a person receives after retiring from work, which can come from various sources such as pensions, investments, and savings.

Compounded Semi-annually

Interest on a loan or investment calculated twice a year, adding the interest to the principal for future calculations.

Withdrawals

The act of taking money out of an account, which can decrease the account balance.

Compounded Semi-annually

An interest calculation method where interest is added to the principal balance twice a year, affecting the total interest earned or paid.

Q11: Which of the following statements regarding corporate

Q35: Employer-sponsored qualified retirement plans and deductible IRAs

Q44: Etta transfers property with an adjusted basis

Q94: Alexis and Terry have been married five

Q95: A corporation has $100,000 of U.S.source taxable

Q103: The maximum amount of the American Opportunity

Q113: The qualified retirement savings contributions credit is

Q122: A tax bill introduced in the House

Q127: Check the supplementary (current developments)material.

Q128: Jacob,who is single,paid educational expenses of $16,000