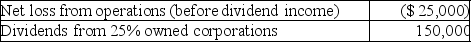

Jenkins Corporation has the following income and expense items during the current year:  The allowed dividends-received deduction is

The allowed dividends-received deduction is

Definitions:

Mainstream

Dominant trends or prevailing cultural norms and values that are widely accepted and practiced by the majority within a society.

Crime Family

An organized crime syndicate structured along familial lines, often involved in various illegal activities across generations.

High Culture

Cultural products and practices considered superior or prestigious by society's elite, often associated with the arts, literature, and classical music.

Values

Core beliefs or standards that guide attitudes, behaviors, and judgments in an individual or within society.

Q32: A partnership's liabilities have increased by year-end.As

Q42: When a partnership interest is sold,ordinary income

Q70: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q72: In the Current Model,investment earnings are taxed

Q81: Dixie Corporation distributes $31,000 to its sole

Q82: In the Deferred Model,investment earnings are taxed

Q95: In 2017,Sam is single and rents an

Q96: Gifts of appreciated depreciable property may trigger

Q115: A wage cap does not exist for

Q146: The person claiming a dependency exemption under