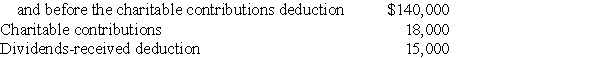

Hazel Corporation reported the following results for the current year:

Taxable income before the dividends-received deduction

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryforward to next year?

What is the amount of the taxable income for the current year and what is the amount of the charitable contributions carryforward to next year?

Definitions:

Marginal Cost

The additional cost resulting from the creation of one more unit of a product or service.

Economies of Scale

The cost advantages that enterprises obtain due to their scale of operation, with cost per unit of output generally decreasing with increasing scale as fixed costs are spread out over more units of output.

Unit Costs of Production

The total expense incurred by a company to produce, store, and sell one unit of a particular product or service.

Q38: The health insurance premium assistance credit is

Q42: If a taxpayer has gains on Sec.1231

Q44: Etta transfers property with an adjusted basis

Q65: According to the Statements on Standards for

Q87: Tom and Alice were married on December

Q91: Tyne is single and has AGI of

Q105: Ariel receives from her partnership a nonliquidating

Q113: Guaranteed payments are not deductible by the

Q123: There are no questions for this section.

Q145: For purposes of the accumulated earnings tax,reasonable