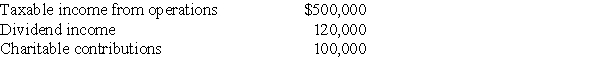

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Definitions:

Moderate Intravenous Sedation

A controlled sedation method, administered through an IV, that decreases consciousness but allows the patient to maintain their own airway and respond to verbal commands.

Airway Compromise

A critical condition where the patient's breathing pathway is obstructed or at risk, necessitating immediate medical intervention.

Electrocardiogram

A test that measures the electrical activity of the heart to identify various heart conditions.

Electrode Sites

Specific locations on the body where electrodes are placed for monitoring physiological electrical activity or administering electrical therapy.

Q1: Sec.1245 can increase the amount of gain

Q15: On January 1 of this year (assume

Q20: Cooper can invest $10,000 after-tax dollars in

Q39: Frank,age 17,received $4,000 of dividends and $1,500

Q70: Indicate which courts decided the case cited

Q71: Hong earns $127,300 in her job as

Q74: The general business credits are refundable credits.

Q101: Individuals Terry and Jim form TJ Corporation.Terry

Q117: A corporation which makes a charitable contribution

Q133: In 2017,the standard deduction for a married