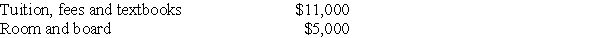

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2017:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Humanistic Approach

A perspective in psychology that emphasizes the study of the whole person and the uniqueness of each individual’s experience.

Aggressive Behavior

Actions that aim to harm or injure another individual, either physically or psychologically, often as a response to frustration or threat.

Basic Needs

Fundamental physiological and psychological necessities required for human survival and well-being, such as food, water, shelter, and belonging.

Introverted

Characterized by or reflecting a preference for inner mental activities rather than engagement with the external environment and social interactions.

Q12: Describe the differences between the American Opportunity

Q21: Rondo Construction,a calendar-year taxpayer,starts a new long-term

Q45: Advance approval and the filing of Form

Q47: If the threat of condemnation exists and

Q64: For purposes of the accrual method of

Q72: Maura makes a gift of a van

Q75: Lucy,a noncorporate taxpayer,experienced the following Sec.1231 gains

Q84: All of the following statements are true

Q95: A corporation has $100,000 of U.S.source taxable

Q112: Which of the following will be separately