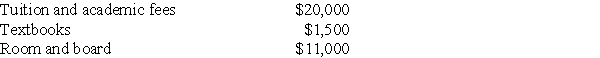

Burton and Kay are married,file a joint return with an AGI of $116,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2017:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Definitions:

Brainstem

The posterior part of the brain, adjoining and structurally continuous with the spinal cord, responsible for vital life functions such as breathing, heart rate, and blood pressure.

Midbrain

An area of the brainstem involved in vision, hearing, motor control, sleep/wake, arousal (alertness), and temperature regulation.

Caffeine

A stimulant of the central nervous system found in coffee, tea, chocolate, and various medications, known for its ability to reduce fatigue and improve concentration.

Nicotine

A stimulant and potent parasympathomimetic alkaloid that is naturally produced in the nightshade family of plants and is widely used for its stimulating and relaxing effects.

Q2: A corporation distributes land with a FMV

Q4: Regular and memorandum decisions have the same

Q15: All C corporations can elect a tax

Q18: The federal income tax is the dominant

Q21: During the current year,Kayla recognizes a $40,000

Q66: Daniel transfers land with a $92,000 adjusted

Q72: Discuss the tax consequences of a complete

Q76: Ike and Tina married and moved into

Q129: An S corporation recognizes gain or loss

Q139: Runway Corporation has $2 million of gross