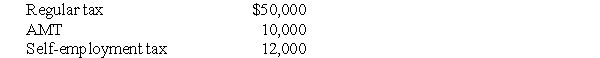

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $48,000.

Definitions:

Q5: When preparing a tax return for a

Q11: Yulia has some funds that she wishes

Q19: Shafiq,age 16,works part-time at the local supermarket

Q30: In order for an asset to be

Q36: Marta purchased residential rental property for $600,000

Q56: Explain the difference between expenses of organizing

Q76: Ike and Tina married and moved into

Q104: Describe the tax treatment for a noncorporate

Q106: Each of the following is true of

Q136: S corporation shareholders who own more than