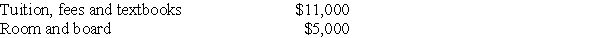

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2017:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Growth and Diversification

Strategies that companies employ to increase size, expand product lines, or services, and enter new markets to reduce business risk.

Strategies for Growth

Plans or approaches adopted by a business to increase its size, revenue, market share, or competitive positioning.

SWOT Analysis

A strategic planning tool that assesses the strengths, weaknesses, opportunities, and threats related to business competition or project planning.

Product Life Cycles

The stages a product goes through from development and introduction to growth, maturity, and decline in the market.

Q20: Lee and Whitney incurred qualified adoption expenses

Q54: CPA Associates,a cash-basis partnership with a calendar

Q61: In the syndication of a partnership,brokerage and

Q65: A taxpayer exchanges an office building held

Q66: The building used in Tim's business was

Q93: Why should tax researchers take note of

Q98: A taxpayer purchased a factory building in

Q99: Hal transferred land having a $160,000 FMV

Q105: For purposes of the limitation on qualifying

Q113: The purpose of Sec.1245 is to eliminate